Why is having Cancer Insurance so important? Many people underestimate the financial impact of a critical illness such as Cancer.

Should you be diagnosed with cancer, you'll want to focus on getting the treatment you need without having to worry about lost income, extra medical costs or everyday living expenses. Payments will be made directly to you, not to the doctors, hospitals or other health care providers. You will receive a check mailed directly to your home.

: This plan provides a lump sum benefit ($5,000 - $50,000) to help pay deductibles, co-insurance, and living expenses when someone experiences a severe critical illness like a heart attack, stroke, major organ transplant, and others. These benefits are not offset by health insurance benefits; and all payments are paid directly to the insured. Voluntary premium payment for OFWs could compromise National Health Insurance Program —PhilHealth chief. Philippine Health Insurance Corp. (PhilHealth) president Ricardo Morales on Tuesday said making the payment of contributions for overseas Filipino workers (OFWs) voluntary may 'compromise' the National Health Insurance Program (NHIP) as provided under the Universal Health.

The Cancer Insurance Plan can help safeguard your finances and provide you with money when you and your family need it most. Payment is yours to use as you see fit and in addition to any other insurance you may have.

Even the best of health plans can leave you with deductibles, copays and costs for out-of-network care. Since disability plans only cover a portion of income, there could be a significant gap between your income and your family's everyday living expenses such as the mortgage, rent, utilities, car payments, groceries and child care payments...just to name a few.

The Cancer Insurance Plan offers fast payment to bring you peace of mind. Get even more peace of mind with easy claims processing, which helps you to receive payment in a timely manner so you can quickly fill the gap between what your medical insurance covers and any out-of-pocket expenses.

Benefit Payment

Full Benefit Cancer All forms of advanced cancers are covered and may qualify for full benefits (as defined by the group policy or certificate).

The Cancer Insurance Plan provides a payment for:

Full Benefit Cancer

All forms of advanced cancers are covered and may qualify for full benefits

(as defined by the group policy or certificate).

Partial Benefit Cancer

Most forms of early stage cancers are covered and may qualify for partial benefits

(as defined by the group policy or certificate).

What Is Voluntary Health Insurance Scheme

Supplemental Health Screening Benefit6

The Cancer Insurance Plan also provides a supplemental health screening benefit. This coverage would be in addition to the Total Benefit Amount payable for the previously mentioned cancers. An annual benefit amount of $50 per calendar year will be paid for taking one of the eligible screening/prevention measures. See Certificate of Insurance for additional information pertaining to this feature

The maximum amount that you can receive through your Cancer Insurance Plan is called the Total Benefit and is two times the amount of your Initial Benefit. This means that you can receive multiple Initial Benefits and Recurrence Benefit payments until you reach the maximum of 200% or $30,000 or $60,000.

Please refer to the table below for the percentage benefit amount for a Covered Condition.

Will my rates increase?

Your premium is based on your issue age, meaning your initial rate is based on your age at the time your coverage becomes effective and your rates will not increase due to age.7

Click here to View the Cancer Insurance Plan Bi-Weekly Rates

How do I enroll?

Enrollment for coverage can be accomplished during one of our two bi-annual Open Enrollment periods.3 APWU members will receive a special mailing notifying them of the Open Enrollment periods.

Who is eligible to enroll?

As an Active APWU member working 20 or more hours per week for the last 90 consecutive days, along with your spouse/domestic partner and dependent children, you cannot be turned down for this coverage. No medical exam is required. No health questions asked. (Pre-existing conditions limitations may apply). APWU Health Plan members automatically receive a 5% premium reduction off this plan's rates. Coverage will become effective on the first day of the period your premium is received following the date the person's enrollment for is received by the Voluntary Benefits Plan.

Coverage is currently NOT available in the following states

MS, MT, NH, OR, SD, UT, WA

Coverage is also NOT available in

PR, GU, AS and Virgin Islands

How do I pay for coverage?

Coverage is paid through convenient payroll deduction. Associate members will be direct billed for their coverage.

Preexisting Condition Exclusion

Preexisting Condition means a sickness or injury for which, in the last 12 months before a Covered Person becomes insured under this Certificate, or before any Benefit Increase with respect to such Covered Person medical advice, treatment or care was sought by such Covered Person, or, recommended by, prescribed by or received from a physician or other Practitioner of the Healing Arts.

We will not pay benefits for Covered Conditions that are caused by or result from a Preexisting Condition if the Covered Condition occurs during the first 12 months that a Covered Person is insured under this Certificate.

How to access your Cancer Insurance Plan Certificate of Insurance

Your Certificate of Insurance will be available to you and your coverage will be effective once we have deducted your first premium payment from your paycheck or for direct billed members, the first day of the period your first premium is received following the date of approval.

Coverage is currently not available in the following states

MS, MT, NH, OR, SD, UT, WA

Coverage is also not available in

PR, GU, AS and Virgin Islands

Any Questions?

Call the following toll-free number 1-800-422-4492

Please Note

You must notify The Voluntary Benefits Plan of any address change for you, your dependents and/or beneficiaries, and any change in employment and union membership status change, life status change (i.e., marriage, divorce, beneficiary or name change), or benefit changes requested. Notice must be in writing.

Administered By:

Voluntary Benefits Plan

P.O. Box 12009

Cheshire, CT 06410

Phone: 1-800-422-4492

Fax: 1-203-754-7847

This plan is underwritten by Metropolitan Life Insurance Company, New York, New York. This summary is a brief description of benefits only and is subject to the terms, conditions, exclusions and limitations of Group Policy No. 122705.

Notes:

1 Coverage for Domestic Partners, civil union partners and reciprocal beneficiaries varies by state. Please contact MetLife for more information.

2 Dependent Child coverage varies by state. Please contact MetLife for more Information.

3 Coverage is guaranteed provided (1)the employee is actively at work. (2)Dependents are not subject to medical restrictions as set forth on the enrollment form and in the Certificate. Some states require the dependent to have medical coverage. Additional restrictions apply to dependents serving in the armed forces or living overseas.

Coverage is guaranteed provided (1) the member is performing all of the usual and customary duties at your job at the employers place of business or at an alternate place approved by your employer. (2) dependents are not subject to medical restrictions as set forth on the enrollment form and in the Certificate. Some states require the insured to have medical coverage. Additional restrictions apply to dependents serving in the armed forces or living overseas.

4 Please review the Disclosure Statement or outline of coverage/Disclosure Document for specific information about cancer benefits. Not all types of cancer are covered. Some cancers are covered at less than the original benefit amount.

5 There is a Benefit Suspension Period between Recurrences. We will not pay a Recurrence Benefit for a Covered Condition that Recurs during a Benefit Suspension Period. We will not pay a Recurrence Benefit for a Full benefit Cancer, a Partial Benefit Cancer or an All Other Cancer unless the Covered Person has not had symptoms of or been treated for the Full Benefit Cancer, Partial Benefit cancer or All Other Cancer.

6 The Health Screening Benefit is not available in all states. See your certificate for any applicable waiting periods. There is a separate mammogram benefit for MT residents and for cases sitused in MT and CA.

7 Please contact MetLife for additional information. The plan is guaranteed renewable, and may not be canceled due to an increase in your age or a change in your health. Premium rates can only be raised as the result of a rate change made on a class-wide basis. Benefits reduce by 25% at age 6 and 50% at age 70. Coverage is guaranteed renewable provided: (1) premiums are paid as required under the certificate; and (2) in a situation where the group policy ends, its not replaced by a substantially similar cancer policy as described in the Certificate.

The MetLife Cancer Insurance Plan is based on the MetLife Critical Illness (CII) policy. MetLife Cancer Insurance includes only the Covered Conditions of Full Benefit Cancer and Partial Benefit Cancer.

METLIFE'S CRITICAL ILLNESS INSURANCE (CII) IS A LIMITED BENEFIT GROUP INSURANCE POLICY. Like most group accident and group health insurance policies, MetLife's CII policies contain certain exclusions, limitations and terms for keeping them in force. Product features and availability may vary by state. In most plans, there is a pre-existing exclusion condition. In most states, after a covered condition occurs there is a benefit suspension period during which benefits will not be paid for a recurrence. MetLife's CII is guaranteed renewable, and may be subject to benefit reductions that begin at age 65. Premium rates for MetLife's CII are based on age at the time of initial coverage effective date and will not increase due to age; premium rates for increases in coverage, including the addition of dependents' coverage, if applicable, will be based on the covered person's age at the time of that increase's effective date. rates are subject to change for MetLife's CII on a class-wide basis. A more detailed description of the benefits, limitations and exclusions can be found in the applicable Disclosure Statement or Outline of Coverage/Disclosure Document available at time of enrollment. For complete details of coverage and availability, please refer to the group policy form GPNP14-CI or contact MetLife for more information. Benefits are underwritten by Metropolitan Life Insurance Company, New York, New York. In New York, availability of MetLife's Issue Age CII products is pending regulatory approval.

MetLife's Critical Illness Insurance is not intended to be a substitute for Medical Coverage providing benefits for medical treatment, including hospital, surgical and medical expenses. MetLife's Critical Illness Insurance does not provide reimbursement for such expenses.

You can offer voluntary benefits to your employees at no direct cost to you. And, contrary to popular belief, you don’t need to be a big company to offer them — some plans require an employer to have a minimum of just three to five employees to qualify. Here’s all you need to know about a voluntary benefits plan and what it can do for your employees and your business.

What are voluntary benefits?

Sometimes called supplemental insurance or employee-paid benefits, voluntary benefits are offered by the employer through the workplace where employees can choose to buy them in addition to the core employee benefits they may get as part of a benefits package.

Payment options are typically flexible. To suit their budget, companies can choose whether voluntary employee benefits are:

- Fully employee-funded

- Part-funded by both employee and employer

In their Voluntary Benefits and Services (VBS) survey, Willis Towers Watson highlighted four critical life needs that voluntary benefits fulfill:

- Health – typically helping employee well-being, while minimizing health risk at a reasonable cost

- Wealth accumulation – protecting income and assets (Willis Towers Watson calls this one Wealth, but arguably a more relevant term is “Lifestyle”)

- Security – protecting our survivors, vulnerable people or even people’s identities

- Personal – products that cover what’s important to the individual interests and needs of the person

What voluntary benefits are available?

Voluntary Insurance Policy

There’s a huge range of voluntary insurance plans out there in the market. Some examples include disability insurance, accident insurance, dental insurance or ‘softer’ benefits that may include retail or ticket discounts, gym memberships or concierge services like collecting dry cleaning.

According to Willis Towers Watson’s 2013 survey, the most common voluntary benefits under the four banners of health, wealth, security and personal are:

Health

Vision insurance

Regular eye exams help maintain healthy vision and are the first line of defense in detecting more serious eye conditions, such as glaucoma, high blood pressure and diabetes. Vision insurance typically helps pay for eye exams, glasses and contact lenses. They may also offer discounts on treatments such as laser eye surgery or eyecare accessories.

Dental insurance

Dental insurance can provide benefits for both routine and more expensive dental procedures that are not covered by most health insurance plans. They typically include cleaning, fillings, sealants, tooth removal, crowns and dentures – and may also provide benefits for regular dental appointments.

Accident insurance

Accident insurance plans can help offset the unexpected medical expenses that may result from a covered accidental injury. Typically, they help cover some of the expenses for initial care, surgery, transportation and lodging, and follow-up care.

Critical Illness insurance

Critical illness insurance can complement major medical coverage by providing a lump-sum benefit for an employee diagnosed with a covered critical illness, such as heart attack, stroke, coronary artery bypass surgery, end-stage renal failure or major organ transplant – among others. Benefits are typically paid directly to the employee, so they can be used where they’re most needed.

Hospital indemnity insurance

Hospital confinement indemnity insurance provides a lump-sum benefit to help with out-of-pocket costs related to a hospital stay. This may include outpatient surgery, diagnostic tests, doctor’s appointments and emergency room trips.

Wealth/Lifestyle

Disabilityinsurance

Disability insurance replaces a percentage of an employee’s income if they become disabled as a result of a covered accident or sickness, to help them continue to make ends meet while they’re out of work.

Legal

Legal typically gives employees access to qualified attorneys at a reduced cost. Coverage usually applies to the most common personal legal matters including family, vehicle, real estate, civil lawsuits and wills.

Financial counseling

Financial counseling helps employees manage their finances. Traditionally, this has mainly focused on retirement plans, but as baby boomers approach the end of their working careers, financial counseling now also includes a range of topics such as credit card debt, investment advice, tax advice, saving and budgeting.

Security

Life insurance

Life insurance pays out a lump sum to help provide financial protection for an employee’s family members in the event of the employee’s death. Coverage can be updated to reflect changes in life such as getting married, buying a home or having a child. Most plans offer spouse and child coverage.

Personal travel accident insurance

Travel accident insurance is designed to provide extra protection while travelling internationally, supplementing coverage typically provided by an accidental death or dismemberment policy. It typically covers emergency medical and legal fees.

Identity theft protection

Identify theft protection does not cover any financial loss as the result of identity theft. Instead, it may include monitoring public records and alerting the employee to any fraudulent use of their personal details, including attempted loans and credit applications. It also covers the cost of repairing the person’s credit history.

Personal

Personal voluntary benefits are those softer offerings that help meet an employee's particular lifestyle needs. These may include:

- Discount merchandise

- Automobile, homeowners or pet insurance

- Concierge services – anything from help booking holidays, shopping, finding tradesmen or picking up dry cleaning

- Umbrella insurance – extra liability insurance against claims and lawsuits above and beyond that typically provided by homeowners or automobile insurance

Willis Towers Watson predicts that identity theft protection, critical illness, pet insurance and even student loan repayment programs are likely to see the fastest growth in the next few years.

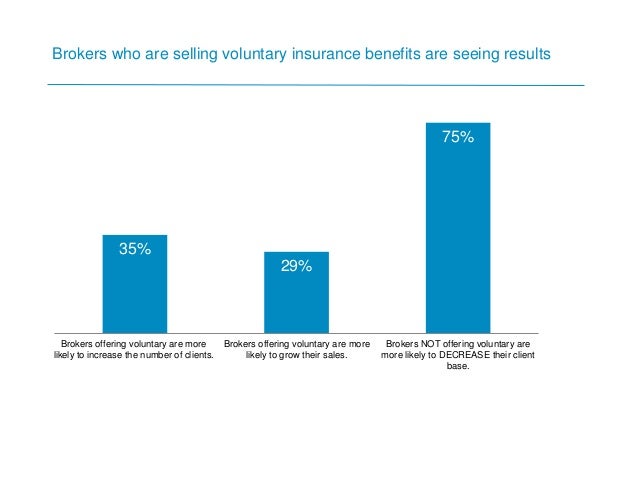

How businesses and employees benefit from voluntary benefits

Benefits to the business

No or low cost

Employers can offer voluntary benefits at no direct cost (i.e. 100% employee-paid), leaving them with just the cost of administration.

A way to control rising health care costs

With the cost of health care on the rise, employers are starting to shy away from providing top end, ‘cover all’ primary health care benefits. Instead, they are choosing less expensive coverage and offering workers a wider range of voluntary health benefits to help fill the gaps.

Attracting and keeping top talent

Employers, especially small businesses where key members of staff can be crucial to the success of the company, are looking for effective ways to retain their staff and recruit the best talent. In fact, according to Gallup economy, employee hiring and retention remains among the top five most important challenges facing business owners1.

Voluntary benefit plans help smaller businesses compete with larger competitors by enabling the provision of a variety of benefits to help them stand out in the war for talent. They can also be a useful tool in employee retention: a benefits package that an employee has chosen and that’s tailored to their changing needs is difficult to give up.

Help with telling your staff – at no direct cost

There’s no point offering benefits if your employees don’t know about them. Communicating employee benefits can be tricky, but with voluntary benefits, some carriers will gladly help with communicating the benefit offerings to employees, either by using tried and trusted support tools, visiting the business for group meetings, or even meeting one-on-one with each employee to help review their own personal needs and best matches for benefits. These meetings may include details about what the benefit provides, a Q&A session and helping both the employer and employee with the actual enrollment process — usually at no direct cost to the employer.

- 77% of workers say the benefits package is an important factor in their decision to accept or reject a job.

Source: EBRI, Views on the Value of Voluntary Workplace Benefits: Findings from the 2015 Health and Voluntary Workplace Benefits Survey, 2015 - 63% of employees say that benefits are one of the reasons they work where they do.

Source: Mercer, Inside Employees' Minds, 2015

Benefits to employees

Confidence

With a vast array of voluntary benefits on the market and a number of companies willing and eager to sell them, people are understandably worried about making the right choice. With their plans being offered at the workplace, employees know that their employer has vetted the carrier and considered the available benefits. Voluntary insurance also pays financial benefits regardless of any other insurance coverage employees have in place – including policies available through government health care exchanges.

Flexibility

The wide range of options available allows employees to choose those voluntary benefits that suit their personal circumstances and lifestyle, whether they’re 20 or 55. Many voluntary benefits are also portable, meaning that if an employee should need to switch jobs, they can continue to keep the coverage as long as they pay the premiums, making a voluntary plan easy to administer and appealing.

Bridging the gap

Voluntary benefits can complement core offerings such as life insurance or disability insurance. Even if an employer provides a core life insurance offering, employees can choose to up their life insurance coverage by adding voluntary life benefits. Voluntary benefits can also provide a financial safety net to help employees with expenses that may not be covered by their core medical plan.

Affordability

As well as potentially being less expensive if purchased through their employer, voluntary employee benefits can usually be deducted via payroll – meaning there’s no need to set up bank drafts or worry about missing premium payments. Plus, pre-tax dollars are often used to pay for many voluntary benefits, meaning employees save even more money. And with most voluntary benefits paid directly to the employee, they can use the money where they need it the most.

Busting the myths – why small businesses don't offer voluntary benefits

Many small business owners are just plain unaware that they are able to offer their staff this kind of benefit, thinking they are just for the bigger players. The vast majority of smaller companies may have never had a conversation with anyone about employee benefits. All these points have led to the creation and perpetuation of a number of widely-held beliefs that are untrue.

Myth – Affordability

Small businesses believe they can’t afford to pay for voluntary benefits, even if they see the positives in offering them.

Truth– Voluntary employee benefits can be partially-funded or even fully-funded by the employee. It means that the company has complete control on how much they decide to spend and what options they choose to add.

Myth – Not enough employees to qualify.

Truth - While it does depend on the carrier and the product, many voluntary benefits are available to businesses with single-figure numbers of staff, and some have no minimum requirements.

Myth – Administering a voluntary benefits plan is costly and complex.

Truth – Certain benefits provide tax advantages and are tax-deductible. Some can be paid for through payroll deduction. Many qualified carriers will be pleased to help with education of employees and can provide easy enrollment and administration, usually at no direct cost – allowing the employer to get on with running their business.

Myth – Employees don't value it.

Truth– This misperception often stems from employers themselves. While most employers believe employees value take-home pay over benefits, employees actually value non-medical insurance benefits and voluntary benefits almost twice as much as employers believe.2

1 'Small Businesses Face Operational, Regulatory Challenges.' Gallup Economy, 28 Feb. 2014. Web. 4 Apr. 2014.

2 'Small Business, Big Benefits: Sharpening the competitive edge with voluntary benefits.' Colonial Life & Accident Insurance Company, May 2014.

Frequently Asked Questions

Got a question about voluntary benefits? Here are some frequently asked questions to help you.

Who can get voluntary benefits?

Is there a minimum number or percentage of employees that must participate in voluntary benefits for them to be viable?

Minimum participation requirements depend on several factors, such as the number of eligible employees and what products are offered. Typically, the minimum number would begin with three to five employees.

Can part-time workers buy or receive voluntary benefits?

Generally yes, as long as they work a minimum number of hours to meet the eligibility criteria for coverage.

Can a contractor be added to voluntary benefits?

Typically, independent contractors cannot be covered under the employer's policy. However, individual policies for some benefits are available.

Can non-profit organizations offer voluntary benefits?

Yes, non-profit and charitable organizations can offer voluntary benefits to their employees.

As a business owner, can I also receive coverage through the voluntary benefits that I am offering to my employees?

Yes. A business owner can apply for voluntary benefits coverage – just like their employees would do.

Are family members able to get voluntary benefits?

Yes. Many voluntary benefits provide the ability to cover your spouse and eligible dependent children.

Are there age limits for certain voluntary benefits?

Each product will have its own unique age requirements. These limits are designed to be flexible to allow the majority of employees actively at work the ability to apply for coverage.

Can home-based or remote workers receive voluntary benefits?

Yes, if they meet the requirements of being full-time eligible employees.

If you already have an existing medical condition can you get coverage?

It depends on the type of product. Some products will require eligible employees to be medically underwritten before they are issued coverage. Other products offer guaranteed-issue coverage, meaning employees can get coverage without answering any medical questions. Certain products may have a pre-existing condition limitation, which means a certain period of time must pass before the person is covered. It’s important to understand any limitations or exclusions specific to the product.

Administration and cost

How much administration is incurred by offering voluntary benefits?

If you find a good carrier, very little. Many offer administrative services such as online billing and payments at little or no cost.

Can employees add coverage throughout the year, or is this limited to an annual enrollment window?

This decision is partly up to the employer. For benefits paid on a pre-tax basis, changes are only allowed annually. Otherwise, an employer can decide how often they would like to make benefits available.

Can employees take their benefits with them if they leave the company?

Many carriers offer voluntary benefits that are portable, meaning employees can take the coverage with them if they change jobs or retire – as long as the premiums continue to be paid.

How much do voluntary benefits cost?

Voluntary benefits range in cost. This can vary based on the type of product, the age of the applicant, their use of tobacco and other factors. Voluntary benefits are designed to be affordable for a wide range of incomes.

What are the tax implications of voluntary benefits?

Some voluntary benefits can be deducted from paychecks before tax – offering savings for employees – whereas others must be paid for after. Your accountant will be best suited to talk to you about the tax savings and implications in offering voluntary benefits.

Health care and voluntary benefits

How do voluntary benefits tie in to the Affordable Care Act (ACA)?

Most voluntary products are considered “excepted benefits” under the current ACA regulations, so are not impacted. A voluntary carrier experienced in benefits communication and education can help educate your employees on their health options – including how this varies by state – and review their individual situation to identify any gaps they may want to fill with voluntary benefits.

Is health insurance available as a voluntary benefit?

No. Health insurance is not a part of voluntary benefits. However, supplemental health benefits can help alleviate some of the out-of-pocket costs that major medical plans may not cover.

Can voluntary benefits be offered if health insurance is not?

Yes. They can and often are. However, it's important that your employees understand the coverage is limited and is not health insurance.

Does an existing cafeteria plan need to be modified to allow for additional voluntary benefit plan options?

It depends if voluntary benefits will be paid for with pre-tax or post-tax dollars. If paid via post-tax dollars, the plan would normally not need to be modified. If premium is paid pre-tax, the plan would need to be modified.

How to get voluntary benefits

How can I offer voluntary benefits?

There are a number of ways to get voluntary benefits, such as through an employee benefits broker or by talking to an insurance agent. Contact an agent about voluntary benefits.

What should I look for in a voluntary benefits provider?

It's important that the carrier works with you (the employer) to help determine what best suits your overall employees' needs as well as your business and budget. Many providers offer support services such as communication and enrollment of benefits, on top of the benefits themselves, which can really help employees make the most suitable selection. For more information, check out this buyer’s guide to voluntary benefits.

How can a small business with a multigenerational workforce offer a range of benefits that suit all needs?

The great thing about voluntary benefits is that they allow you to offer a greater range of coverage to your workforce without impacting your budget. So, if you have employees of all different ages, they can pick and choose which benefits are most beneficial to them and their lifestyle.